Medicare Advantage (MA) Plans – Types and Comprehensive Comparison

In the healthcare sector, Medicare Advantage (MA) plans [Medicare Part C] have become a prominent alternative to traditional Medicare coverage. They offer beneficiaries a unique way to receive comprehensive health benefits through private insurance companies.

Jason Rubin Insurance Services are popular amongst senior citizens around Woodland Hills, CA. You can call them to talk about your concerns regarding healthcare insurance. Let’s delve deeply into the different types of Medicare Advantage plans, their features, benefits, and potential drawbacks. It will help you gain clarity on each MA plan’s nuances.

Types of Medicare Advantage [MA] Plans

MA plans come in various forms, each catering to specific healthcare needs and preferences. The main types include-

-

Health Maintenance Organization (HMO) Plans

- You must choose a primary care physician (PCP) from the network available on the HMO plans.

- For specialist care, you must look for referrals.

- Out-of-pocket costs are low but members are required to accept services from within the plan’s network for non-emergency care.

-

Preferred Provider Organization (PPO) Plans:

- You can receive care from both in-network [PPO plans] and out-of-network providers

- Although the in-network services generally incur lower costs.

- No referrals are necessary for specialist visits.

- Private Fee-for-Service (PFFS) Plans: This scheme determines –

- How much they will pay for healthcare services and how much you must pay.

- You can visit any provider that accepts the PFFS plan’s terms.

- Special Needs Plans (SNP): SNPs plans are aimed to provide specialized care and services to people with special needs. It ensures they receive comprehensive and well-coordinated healthcare.

- Medical Savings Account (MSA) Plans: MSA plan involves depositing money into your account, which can be used to pay for your healthcare expenses. These plans empower you to make your healthcare decision while also attaining financial incentives to manage the cost.

Comparison of Medicare Advantage [MA] Plans

- Costs: With HMO plans monthly premiums and out-of-pocket costs are low. They are an attractive option for budget-conscious people. PPO plans offer more flexibility but premiums and cost-sharing are high. PFFS plans’ costs vary depending on the plan’s terms, while SNP and MSA plans may have unique cost structures.

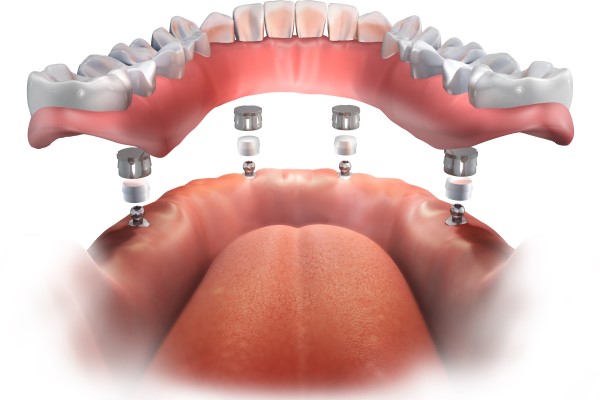

- Coverage: All MA plans must provide at least the same coverage as Original Medicare (Part A and Part B). However, MA plans often include additional benefits, such as prescription drug coverage (Medicare Part D), dental, vision, and hearing services.

- Provider Networks: HMO plans require members to choose a primary care physician and usually limit coverage to in-network providers. PPO plans allow members to visit both in-network and out-of-network providers, albeit with different cost-sharing. PFFS plans may have their own networks, while SNP plans target specific provider networks tailored to the needs of their members.

- Additional Benefits: MA plans frequently offer benefits not covered by Original Medicare, such as gym memberships, wellness programs, and transportation services. These extras contribute to better overall health and quality of life, making them an important factor to consider.

As you continue your journey of lifelong learning, MA Plans coverage knowledge empowers you to make wise choices even as you embrace the senior citizen phase of life.